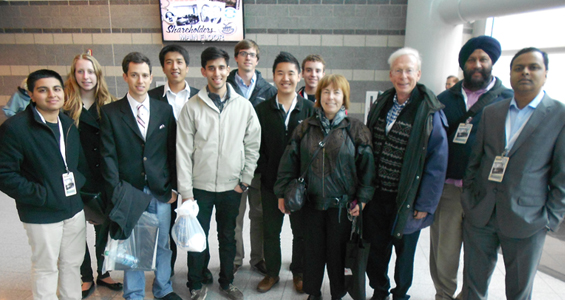

University of Maryland Robert H. Smith School of Business finance faculty members David Kass and Elinda F. Kiss and eight Smith undergraduates recently traveled to Omaha, Neb., to attend the annual shareholder meeting for Berkshire Hathaway, the conglomerate holding company chaired by Warren Buffett.

Kass, who writes a blog about Buffett and Berkshire Hathaway, described the event as an “eye-opening” experience into the investment world for the students, while Kiss said it was a great opportunity for students to learn what a shareholders meetings is like.

Teresa Russell, a junior finance-information systems major and sustainability minor who attended the meeting, agreed with that assessment.

“The meeting itself was very informative and inspired me to learn more about the stock market and how to make smart investment decisions,” she said. “I also enjoyed getting to know the professors and the classmates who attended the trip on a more personal level.”

“The real benefit … comes from just being in that environment,” said Pavan Rangachar, a junior finance major who also attended the meeting. “Just being surrounded by intelligent people from the investments industry while listening to a legendary investor speak will teach interested students a lot.”

Rangachar said he and another student got in line for the meeting at 2 a.m., four-and-a-half hours before the doors were opened.

“We were third and fourth in line out of the entire conference of about 40,000 people,” he said. “The next five hours of waiting were just cold and bitter, but more people started to come, and it was just a period of time where you talk to a lot of other people who are interested in the same thing as you: investing.”

By getting in line that early, they were able to get seats for everyone close to the front of the room. Kiss said being able to sit so close was a highlight of the trip for the students.

Russell said she enjoyed Buffett’s sense-of-humor. “At the beginning of the meeting, after showing a few video clips, music was playing and Warren was dancing around to a Berkshire version of YMCA; I thought it was great that he doesn't take himself too seriously.”

The presentation also included a film featuring Arnold Schwarzenegger in which Buffett attempts to get a part in “Terminator 5,” Kass said.

Although they did not get a chance to meet with Buffett or Berkshire Hathaway’s Vice-Chairman Charlie Munger, the students were able to meet a few “hot shots” of the business world, Russell said.

While dining at Gorat’s, one of Buffett’s two favorite restaurants, the night before the annual meeting, they were seated adjacent to a table that included Andrew Ross Sorkin of The New York Times and CNBC, Doug Kass, founder of hedge fund Seabreeze Partners Management (no relation to Professor Kass), and Mario Gabelli, founder of GAMCO Investors, each of whom chatted and took photographs with the professors and students.

Kiss said the students were thrilled to get “up close and personal” with people they’ve heard about in the investment community.

“It was pretty impressive that he would even talk to us, so that alone was surreal in itself,” Rangachar said regarding meeting Gabelli.

He said he plans to return to Omaha each May to attend the annual meeting. “A friend of mine and I have started looking at booking plane and hotel tickets for next year, and we encourage anyone else who is interested to do the same,” he said.

“Overall, I'm glad that I attended the meeting because it refocused and motivated me to be more proactive about my business education both inside and outside the classroom,” Russell said.

Rangachar also had some advice for students who travel to the annual meeting in the future. “I would advise students with a business card to bring a few copies,” he said. “You will exchange plenty as you meet many investors who either run their own asset management firm or work for a large Wall Street firm. I personally met many other investors, some of whom who live in the DMV area, that looked for interns as well.”

Kass has closely studied Buffett since the early 1980s and is frequently interviewed in business publications as an expert on Buffett. This was the eighth time he has traveled to the Berkshire Hathaway annual meeting, and the third time he has traveled with a group of students from Smith. He plans to continue the student trips in the future. He has also twice taken Smith MBA students to Omaha for private meetings with Buffett.

Kass’s notes about the meeting are posted on his blog.

Peter Haldis, MBA Candidate 2014, Office of Marketing Communications

Media Contact

Greg Muraski

Media Relations Manager

301-405-5283

301-892-0973 Mobile

gmuraski@umd.edu

About the University of Maryland's Robert H. Smith School of Business

The Robert H. Smith School of Business is an internationally recognized leader in management education and research. One of 12 colleges and schools at the University of Maryland, College Park, the Smith School offers undergraduate, full-time and flex MBA, executive MBA, online MBA, business master’s, PhD and executive education programs, as well as outreach services to the corporate community. The school offers its degree, custom and certification programs in learning locations in North America and Asia.