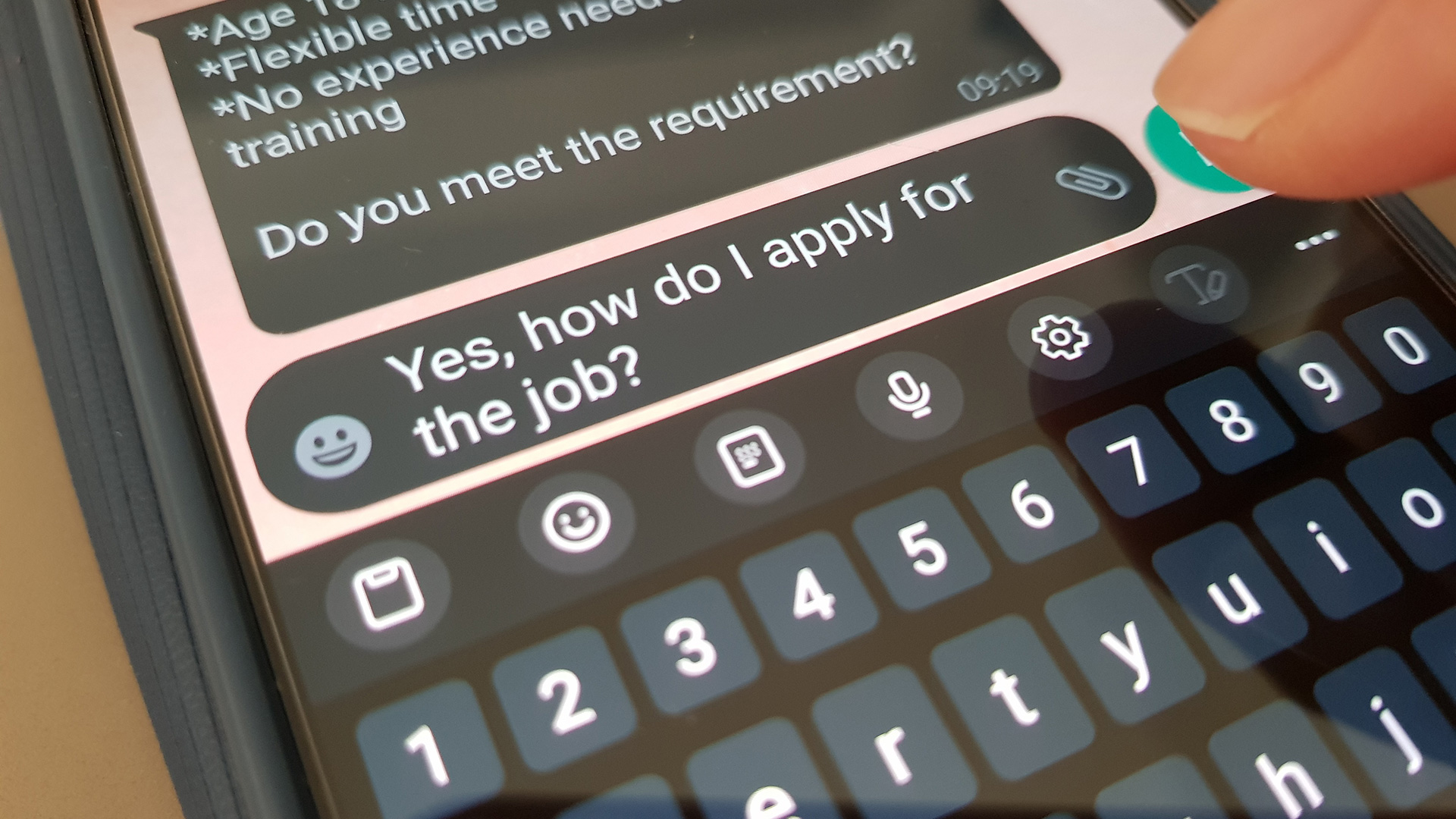

When suspicious text messages started popping up on the phones of students working for the University of Maryland's Justice for Fraud Victims project, they knew something wasn't right. These weren't your typical spam texts. They were sophisticated job offers, supposedly based on "recommended resumes" that none of the students had ever submitted.

But these weren't typical students either. As volunteer fraud investigators working with real victims, they'd developed a keen eye for deception.

"The timing was almost uncanny," says Samuel Handwerger, CPA, accounting lecturer and faculty advisor for the project at Maryland's Robert Smith School of Business. "Our students were receiving these suspicious job offers right as the Federal Trade Commission was uncovering a massive surge in similar scams nationwide."

The students’ instincts “proved spot-on,” he adds. Their quick research revealed they'd spotted the leading edge of what the FTC now calls "task scams"—a fraud scheme that has exploded from zero reported cases in 2020 to 20,000 reports in just the first half of 2024, with victims losing over $220 million.

"What makes this particularly interesting is how our students, who spend their time helping real fraud victims, immediately recognized the red flags that others might miss," Handwerger notes. “While legitimate job recruiters don't typically send unsolicited texts about positions you never applied for, these scammers were counting on people's desperation for flexible online work."

The scam's playbook, as identified by both the student investigators and the FTC, is particularly devious, Handwerger says. Victims are initially paid small amounts for simple tasks like "app optimization" or "product boosting," building their confidence in the scheme. Then comes the twist: They're asked to invest their own money to “unlock” bigger earnings, with those funds, often in cryptocurrency, disappearing forever.

“The irony wasn't lost on us,” says Amol Ajmera, a Smith finance and accounting major and senior volunteer with the project. “These texts are so ubiquitous that even student fraud investigators aren’t safe from being targeted.”

The discovery has energized the student volunteers' mission to protect others, Handwerger says. Working with university faculty and law enforcement, they're now helping spread awareness across campus and into the broader community about these evolving threats.

Handwerger adds: “It's a proud moment that showcases the real-world impact of the program. Our students aren't just learning about fraud. They're actively helping prevent it.

When scammers targeted our campus, they didn't find victims. Instead, they found a network of trained investigators ready to expose their scheme."

Those who suspect being targeted for task scams or other types of financial fraud can contact Justice for Fraud Victims for assistance via JFV Casework Requests.

Media Contact

Greg Muraski

Media Relations Manager

301-405-5283

301-892-0973 Mobile

gmuraski@umd.edu

About the University of Maryland's Robert H. Smith School of Business

The Robert H. Smith School of Business is an internationally recognized leader in management education and research. One of 12 colleges and schools at the University of Maryland, College Park, the Smith School offers undergraduate, full-time and flex MBA, executive MBA, online MBA, business master’s, PhD and executive education programs, as well as outreach services to the corporate community. The school offers its degree, custom and certification programs in learning locations in North America and Asia.