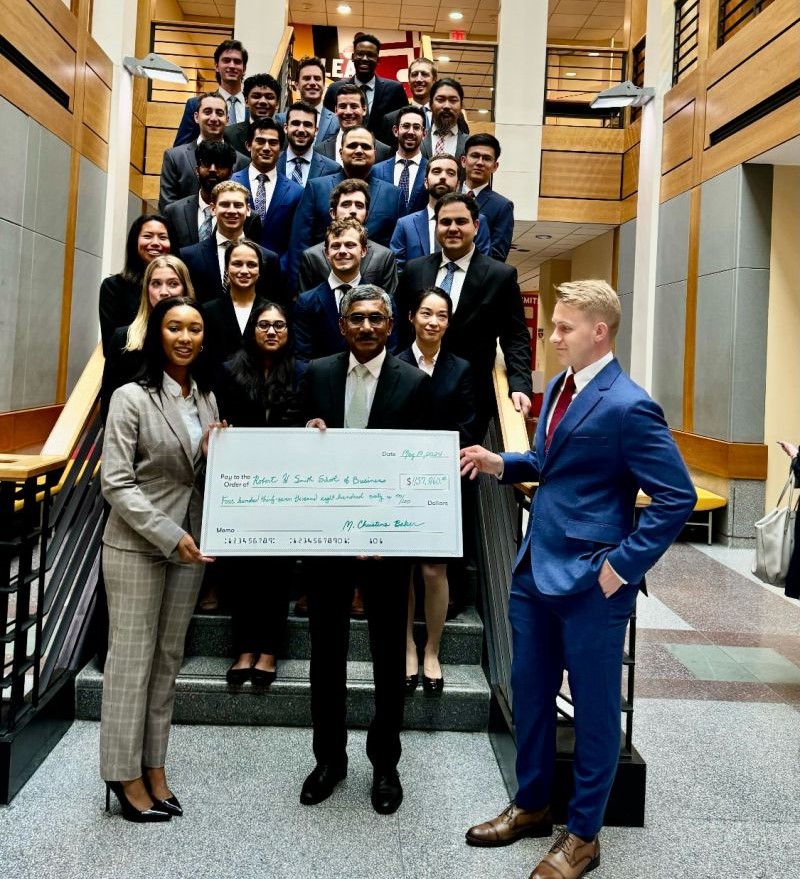

In May, the University of Maryland’s Robert H. Smith School of Business received a $437,860 grant from the Robert H. Smith School of Business Foundation.

The grant represents roughly 4% of the foundation’s assets managed by the Smith School’s student investment funds—the Mayer, Senbet and Global Equity funds. Collectively, the funds currently manage approximately $11.5 million in assets.

“We are thankful and appreciative of the students' efforts and the continued support of the Robert H. Smith School of Business Foundation,” says Smith School Dean Prabhudev Konana. "These opportunities help our students not only to be more competitive in pursuing jobs but also in continuing to strengthen the reputation of the Smith School.”

The funds exemplify the Smith School’s longstanding commitment to providing students with experiential learning opportunities. Participating students gain practical investment experience and are well-equipped to seek jobs in the financial services industry or corporate finance with a non-financial corporation. Student fund alumni have received job opportunities at companies such as Ernst & Young, Deloitte, J.P. Morgan, Capital One and Goldman Sachs, among others.

The Mayer Fund, previously the “Terrapin Fund,” was founded in 1993 through a $250,000 contribution from the Smith School’s College of Business and Management Foundation. The fund sees involvement from a team of ten to twelve students across the school’s Full-Time MBA, Master of Finance and Master of Quantitative Finance programs. It uses the S&P 500 as a benchmark and follows an investment strategy of Growth at a Reasonable Price (GARP). The Mayer Fund’s current assets under management currently hold at roughly $8 million. Between April 1, 2023, and March 1, 2024, the fund saw a one-year return of nearly 30% and almost 21% for its overall 2024 fiscal return.

The Senbet Fund, modeled after the Mayer Fund and initially named the Smith Fellows Fund, was launched in 2006 as a year-round, advanced undergraduate program course in portfolio management and equity analysis. Each year, the student team, comprised of two portfolio managers and ten equity analysts, is tasked with maintaining the long-term performance goal of outpacing the appreciation of the S&P 500 on a risk-adjusted basis. Its current assets under management are valued at roughly $2.8 million. Between April 1, 2023, and March 1, 2024, the fund saw a one-year return of nearly 30% and 21.64% for its overall 2024 fiscal return.

The Smith School’s Global Equity Fund was established in 2009 with a $250,000 contribution and invests primarily in common stocks of global companies based worldwide and whose shares trade in the US. In a course that meets once per week over an entire year, a team of 20 students from the school’s Flex MBA, Master of Finance and Master of Quantitative Finance programs work toward outperforming a global benchmark (80% MSCI All Country ex-US Index plus 20% US Total Market Index). Students are assigned roles within the fund as portfolio managers or equity analysts specializing in specific geographic markets or industries. The Global Equity Funds' current assets under management are valued at $620,000. Between April 1, 2023, and March 1, 2024, it observed a one-year return of 16.30% and a 2024 fiscal return of 12.22%.

Media Contact

Greg Muraski

Media Relations Manager

301-405-5283

301-892-0973 Mobile

gmuraski@umd.edu

About the University of Maryland's Robert H. Smith School of Business

The Robert H. Smith School of Business is an internationally recognized leader in management education and research. One of 12 colleges and schools at the University of Maryland, College Park, the Smith School offers undergraduate, full-time and flex MBA, executive MBA, online MBA, business master’s, PhD and executive education programs, as well as outreach services to the corporate community. The school offers its degree, custom and certification programs in learning locations in North America and Asia.