As president of the World Bank Group and Under Secretary of the U.S. Treasury for International Affairs, David Malpass has stood on the frontlines of international economic policy. On Tuesday, Oct. 15, he imparted his experiences and wisdom to students at the University of Maryland’s Robert H. Smith School of Business.

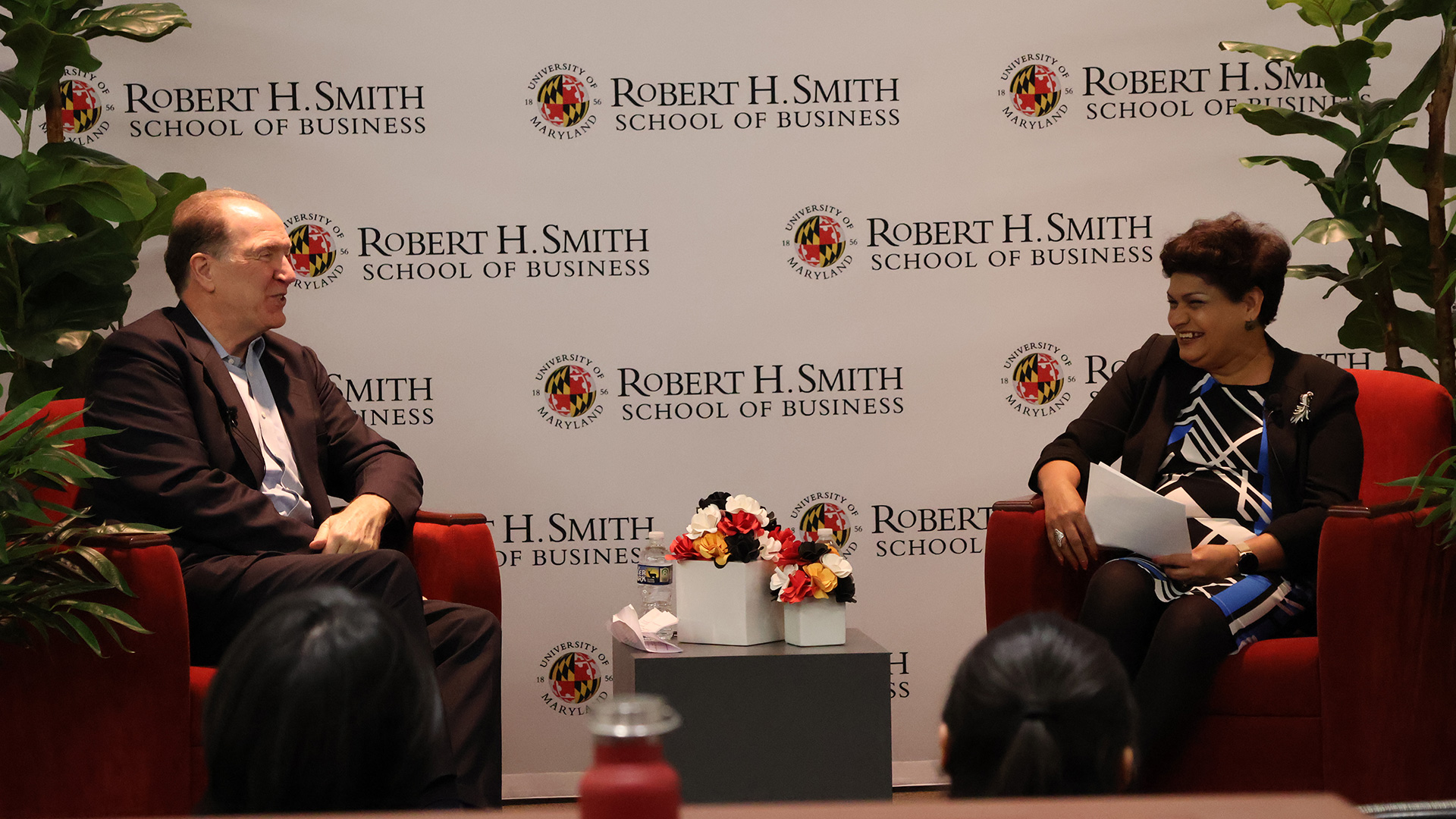

Malpass discussed topics such as the expansion of the Federal Reserve and the global implications of the United States national debt during a conversation with Rajshree Agarwal, Rudolph Lamone Chair of Strategy and Entrepreneurship and director of the Ed Snider Center for Enterprise and Markets.

The “International Trade, Development and Migration” event was hosted by the Ed Snider Center for Enterprise and Markets as part of its Fact-Based Discourse Initiative. The hour-long conversation was held at Van Munching Hall in front of an audience of faculty and students, including those from the school’s Smith Business Leadership Fellows program.

“The Ed Snider Center is proud to sponsor the Fact-Based Discourse Initiative, which serves as the cornerstone for co-curricular efforts for Smith undergraduate and graduate programs like SBLF and the EMBA. These enable our students to challenge their thinking and engage in challenging conversations,” says Agarwal. “The ability to challenge assumptions is key to success in solving meaningful problems through human enterprise and the creation of win-win relationships in business and society.”

Here are five insights Malpass shared during the event:

Payment systems pave economic progress. When assessing a country’s economic situation, Malpass starts his analysis at the core—currency and payment systems. He cited two notable examples from China and Russia. The former overcame economic instability and high inflation in the 1990s, which helped its citizens increase median income, keep money in their pockets, and ultimately become one of the most powerful economies in the world. On the other hand, Russia never developed its currency's value to the extent that it encouraged market-based exchanges. Now, Malpass considers money-transferring applications as economic “bright spots” spurring economic growth worldwide.

“These apps are incredibly empowering by allowing people to exchange money without being stolen or devalued,” said Malpass. “If we discuss how to improve a country’s economy, let’s start with what their currency is doing and why, then we can find a path to better growth.”

Economic prosperity relies on the rule of law. With the 250th anniversary of the signing of the Declaration of Independence just on the horizon, Malpass noted the Founders’ emphasis on establishing the rule of law as a foundational building block. He recounted his work with the U.S. State Department in the 1990s, traveling throughout Latin America and encouraging countries to do the same by enacting short constitutions. Ultimately, those constitutions create a contract and legal system that spur investment.

“Through a legal system, if I lend you money, then I have reason to think you’ll give it back. Without that confidence in the system, you won’t see that interchange,” said Malpass. “We don’t want to say that equals progress, but we do want to say having a rule of law that people agree on and performs the basis for your society – that will work well in the end.”

The Federal Reserve needs a unified mission. According to Malpass, the Federal Reserve’s core mission is to “allow and facilitate price stability and full employment. " However, since the 2008 economic crisis, it has taken on even more functions, including buying bonds and being the principal regulator of banks. Those newer functions sometimes contradict its initial purpose, he said. Concerning bond buying, the Fed is operating more as a large hedge fund, which he considers a function it shouldn’t be nearly as engaged in as much as it is.

“I think government agencies should try to figure out what exactly the mission is and whether they can do it well. We shouldn’t be looking to enlarge it endlessly,” said Malpass.

The national debt has massive implications for the world. In 1983, the total U.S. national debt was roughly $1.83 trillion and has since risen to nearly $36 trillion, while the marketable debt lies over $27 trillion. Regardless of what people choose to track, “it’s gigantic,” said Malpass. Even more concerning in Malpass’s eyes is its growth rate, which is faster than the U.S. economy’s growth rate and, in turn, faster than the world economy. In the U.S., the impact of debt is manifested through a “crowding out” effect when the government takes money that might otherwise be lent to businesses. The same effect, he said, is now occurring elsewhere in the world, signifying a global responsibility on the part of the U.S. to alleviate the debt to avoid distorting markets.

“I've thought that there needs to be more checks and balances within our system because otherwise, the national government will continue to grow,” said Malpass. “From the regulation standpoint, we talk about how the government keeps borrowing money and hiring workers who write regulations that slow everything down. You can think of it as an unhealthy cycle we must break out of.”

There’s still much to be optimistic about. Human ingenuity, rapid technological advancement and an enduring will to overcome hardships all contribute to Malpass’s justification for maintaining an optimistic outlook for the future. One example was the recent SpaceX booster landing in October, which he called a “full-circle” moment that highlighted humanity’s progress since the Apollo missions of the 1960s. Apply those factors to an issue like the national debt, and “we’ll find a way,” he said.

“I’m more struck by the wonders of the world than the negatives, but it’s part of my job to continue to fight with the negatives,” said Malpass.

Take part in the Ed Snider Center for Enterprise and Markets' next Fact Based Discourse Initiative event, “Social Media Business Models & the Promotion of Extremism and Zero-Sum Mindsets,” featuring the Smith School’s Balaji Padmanabhan, professor of decision, operations and information technologies, on Tuesday, Nov. 19, at Van Munching Hall.

The events of the Fact-Based Discourse Initiative are one of several sponsored by the Heterodox Academy Campus Community at the University of Maryland. The group, launched by Rajshree Agarwal, Rudolph Lamone Chair of Strategy and Entrepreneurship and director of the Ed Snider Center for Enterprise and Markets; Jacqueline Manger, managing director of the Ed Snider Center; Sebastian Galiani, Mancur Olson Professor, from the College of Behavioral and Social Sciences; and Rellie Derfler-Rozin, professor of management and organization, will plan additional programming throughout the year, including courses, panel discussions, and speaker events, to promote open inquiry and viewpoint diversity.

Media Contact

Greg Muraski

Media Relations Manager

301-405-5283

301-892-0973 Mobile

gmuraski@umd.edu

About the University of Maryland's Robert H. Smith School of Business

The Robert H. Smith School of Business is an internationally recognized leader in management education and research. One of 12 colleges and schools at the University of Maryland, College Park, the Smith School offers undergraduate, full-time and flex MBA, executive MBA, online MBA, business master’s, PhD and executive education programs, as well as outreach services to the corporate community. The school offers its degree, custom and certification programs in learning locations in North America and Asia.